China Daily » Capital News

BEIJING, China, Jul 16 — China’s economy grew by 5 percent in the first half of this year despite challenges such as still-weak demand and a complex external environment, providing a solid base for achieving the whole-year growth target, analysts said on Monday.

However, they cautioned that the weaker-than-expected second-quarter performance indicates that the foundation for economic stabilization is not yet solid, highlighting the need to strengthen both countercyclical and cross-cyclical adjustment of macro policies to prop up the world’s second-largest economy.

Countercyclical adjustments focus more on short-term remedies to put the brakes on the current trend, while cross-cyclical adjustments aim to bolster long-term, sustainable growth with long-term solutions to tackle problems across multiple economic cycles.

The policy focus should be placed on stronger fiscal and monetary stimulus to boost domestic demand, alongside measures to tackle structural issues and foster new growth drivers, they said. This should include more property easing steps to support the ailing real estate sector, further unleashing services consumption potential, the analysts added.

Data from the National Bureau of Statistics showed on Monday that China’s GDP grew by 4.7 percent from a year earlier in the second quarter, cooling from 5.3 percent growth in the first quarter of the year.

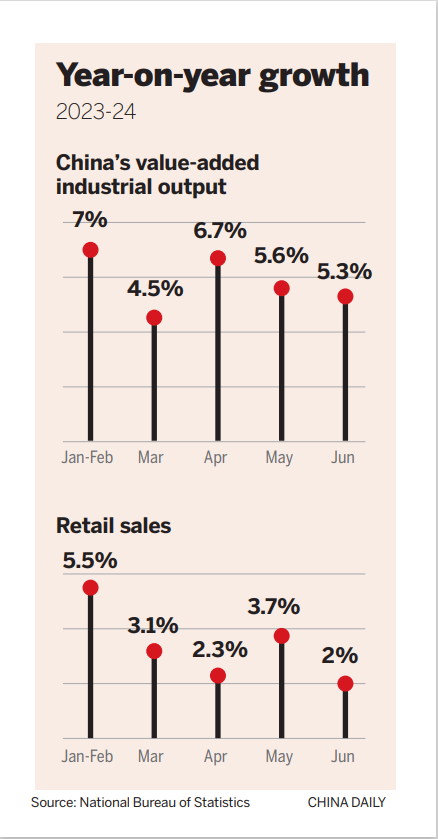

China’s industrial output grew by 5.3 percent in June from a year earlier, while fixed-asset investment grew by 3.9 percent year-on-year in the January-June period.

Zhou Maohua, a researcher at China Everbright Bank, said, “The second-quarter growth fell short of market expectations mainly due to the slump in retail sales growth, while the robust investment in infrastructure and manufacturing and better-than-expected foreign trade provided strong support for economic stabilization.”

Statistics from the NBS showed that despite the low growth of retail sales, a key measurement of consumer spending, which stood at 3.7 percent year-on-year in the first half of the year, retail sales of services registered relatively strong growth, expanding by 7.5 percent year-on-year.

Zhou remained optimistic about the consumption recovery and economic growth in the second half, given the steady rebound in demand for services domestically, stabilization in the employment market and continuous improvement in personal incomes.

“China’s consumption and domestic demand will likely pick up steadily in the remainder of the year, with the help of stronger policy stimulus, spending sprees during holidays and gradual stabilization in the property sector,” Zhou said.

NBS data showed that China’s property investment fell by 10.1 percent in the first six months of this year, compared with the same period a year earlier, which was flat compared with the figure in the first five months.

The country has recently taken a slew of measures, such as cutting minimum down payment ratios for individuals’ commercial housing mortgages, in order to boost the property market.

Lu Ting, chief China economist at Nomura, said he believes China is heading in the right direction in terms of addressing the housing woes.

“The country has already pivoted from building public housing to ensuring the delivery of numerous pre-sold homes to rebuild buyers’ confidence, marking a significant step forward toward reducing the woes of the property sector,” he said.

Despite the stimulus policies nationwide to prop up the real estate sector, Darius Tang, associate director of corporates at Fitch Bohua, a wholly owned subsidiary of Fitch Ratings in Beijing, said that while the property sector may still be a drag on the economy, China’s economic driver for the rest of the year will come mainly from resilience in exports, strong manufacturing investment and more aggressive policies to boost consumption growth.

Helped by a rebound in external demand and supportive fiscal and monetary policies, China’s economy is expected to gain momentum for further recovery this year, with an estimated annual growth rate of 5.3 percent — higher than the country’s yearly growth target of around 5 percent, said the ASEAN+3 Macroeconomic Research Office.

For more visit China Daily

For subscriptions on news from China Daily, or inquiries, please contact China Daily Africa Ltd on +254 733 566 499 or write to enquiries@chinadailyafrica.com